3.2 — Efficient Breach

ECON 315 • Economics of the Law • Spring 2021

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/lawS21

lawS21.classes.ryansafner.com

Breach of Contract

Breach of Contract

If a contract is a (legally enforceable) promise...

...what should happen when the promise is broken?

Examples:

- I signed a contract with no intention of upholding it

- or I signed it in good faith, intending to keep it

- but circumstances changed, making my performance less desirable, maybe inefficient!

Example

- Example: Consider a brewery and an ice company. The brewery (buyer) contracts to have the ice company (seller) deliver ice for storing beer.

- Promisor: ice company (seller)

Promisee: brewery (buyer)

V: value of performance to promisee

- revenues from beer sold

- C: cost of performance to promisor

- cost of supplying ice to brewery

- P: contract price buyer and seller agreed on

Example

Lots of things could happen in between:

- Price of ice goes up, raising costs C>P

- efficient to deliver, but ice company no longer wants to

- Or raises costs C>V

- no longer efficient to deliver

- Another brewery (with V′>V) could show up and offer the ice company P′>P

- Ice delivery person could break a leg, making it impossible to deliver

Breach of Contract

A contract is a promise

Breach of contract is when promisor fails to keep a promise

- To make promise legally binding, must be some consequence to breach

So what should happen when a contract is breached?

- If penalty too small: law has no bite

- If penalty too big: promises might be kept that are inefficient

- Can we design law to get breach only when it is efficient to breach?

Efficient Breach

| Buyer Payoff | V−P (Buyer Surplus) |

| Seller Payoff | P−C (Seller Surplus) |

| Joint Payoff | V−C (Gains from Trade) |

Net gains from the contract performed

Efficient Breach

| Buyer Payoff | V−P (Buyer Surplus) |

| Seller Payoff | P−C (Seller Surplus) |

| Joint Payoff | V−C (Gains from Trade) |

Net gains from the contract performed

- Suppose the cost of delivery C is uncertain when the contract is made

Efficient Breach

| Buyer Payoff | V−P (Buyer Surplus) |

| Seller Payoff | P−C (Seller Surplus) |

| Joint Payoff | V−C (Gains from Trade) |

Net gains from the contract performed

Suppose the cost of delivery C is uncertain when the contract is made

Once the actual C is realized, promisor (ice company) must decide to perform or breach contract

- C<V: efficient for promisor to perform

- C>V: efficient for promisor to breach

Efficient Breach

Condition for efficient performance: C<V

- Promisor's cost to perform < Promisee's benefit of performance

- Social benefit of breach < social cost of breach

Condition for efficient breach: C>V

- Promisor's cost to perform > Promisee's benefit of performance

- Social benefit of breach > social cost of breach

What Will Actually Happen?

We know it's efficient to breach when C>V, but what will promisor actually do?

- Depends only on their personal costs & benefits

Promisor's cost to perform < promisor's liability from breach ⟹ Promisor will perform

Promisor's cost to perform > promisor's liability from breach ⟹ Promisor will breach

What Will Actually Happen?

D: damages court awards to Promisee (paid by Promisor)

Promisor will perform: −D>P−C

Promisor will breach: −D<P−C

What Will Actually Happen?

D: damages court awards to Promisee (paid by Promisor)

Promisor will perform: −D>P−C

Promisor will breach: −D<P−C

Can we design the law to only get efficient breach of contract?

Getting Only Efficient Breach

- What value of D will equate the socially-optimal outcome and the promisor's private incentives to perform/breach?

D=V−P

- Set liability from breach = promisee's net gain from performance, then promisor will only breach when it is efficient

- When promisor breaches, should owe penalty exactly equal to the benefit promisee expected to recieve

- This is expectation damages!

| Buyer Payoff | V−P (Buyer Surplus) |

| Seller Payoff | P−C (Seller Surplus) |

| Joint Payoff | V−C (Gains from Trade) |

Net gains from the contract performed

An Externalities View of Breach

If Promisor breaches contract, imposes a negative externality on Promisee

- Promisee expected V−P payoff if Promisee performed

- Under breach, Promisee is V−P worse off

If Promisor has to pay V−P in damages for breach, then they internalize the externality

- Now Promisor's decision no longer affects Promisee's payoff

- Gets the same surplus whether or not contract is performed

- With ext. internalized, Promisor chooses efficiently when deciding to perform or breach

Reliance

Return to Our Example

- Example: Consider a brewery and an ice company. The brewery (buyer) contracts to have the ice company (seller) deliver ice for storing beer.

- V: value of performance to promisee

- revenues from beer sold

- C: cost of performance to promisor

- cost of supplying ice to brewery

Return to Our Example

- Example: Consider a brewery and an ice company. The brewery (buyer) contracts to have the ice company (seller) deliver ice for storing beer.

Suppose the two companies agree on a price P and the ice company expects E[C]<P

Then both parties can expect to benefit from performance: V>P>E[C]

Reliance

Suppose that in preparation for sale, the brewery invests R in producing a certain amount of beer, prior to the ice actually being delivered

This is a reliance investment, which depends on the performance of the contract

- Increases the value of performance to promisee

- Increases the social cost of breach

Another goal of contract law is to attain optimal level of reliance

Reliance: Example

V depends on the value of R

- More R makes V higher to promisee

But must choose R before contract is performed/breached (ice delivered or not) and is a sunk cost (beer will spoil if ice not delivered)

Reliance: Example

D: damages the court awards in the event of breach (promisor pays promisee)

What value of D is efficient, i.e. induces promisor to breach only when it is efficient to do so?

Breach

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−P | D |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−C | 0 |

Breach with Reliance

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

Breach with Reliance

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

- Recall condition for efficient breach: C>V

- cost of performance to promisor > value of performance to promisee

Breach with Reliance

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

Recall condition for efficient breach: C>V

- cost of performance to promisor > value of performance to promisee

Note since R is a sunk cost, doesn't affect this condition!

- Joint payoff from performance > joint payoff from breach if: V−R−C>−R

- R's cancel, yielding C>V

Reliance: Example

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

Now consider what Seller will actually choose to do (once it knows C):

Seller will breach when C>P+D

- Left: benefit of breach (savings in cost)

- Right: cost of breach (lost price plus damages)

- Breaches when private benefits > private costs

Reliance: Example

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

- We want law to incentivize seller to breach only when it is efficient

- So set C>P+D equal to C>V, i.e.

- Set damages D=V−P, equal to consumer surplus

- Seller compensates buyer for the buyer's lost surplus from the exchange

What Do Courts Set Damages At?

We know what damages induce efficient breach (D=V−P), but what damages do courts actually set in breach cases?

Expectation damages: amount to make the promisor as well off as if the contract had been performed

- by far the most popular method

- We've seen this induces breach only when it's efficient ✅

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

What Do Courts Set Damages At?

- Reliance damages: amount to make the promisor as well off as if the contract had never been made

- reference point is pre-contract status, rather than post-performance status

- buyer's pre-contract payoff was 0, so in breach case, set D=R

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

What Do Courts Set Damages At?

Under reliance damages (D=R), what are seller's incentives to breach?

Recall seller will want to breach when C>P+D

- If D=R, then:

Seller will want to breach when C>P+R

- Since V−P>R (promisee's reliance investment must be less than the gain from performance, otherwise unprofitable to invest!)...,

- Then P+R<V, implying seller will breach too often under reliance damages (since C<V is inefficient to breach)

| Payoffs | Performance | Breach |

|---|---|---|

| Buyer's Payoff | V−R−P | D−R |

| Seller's Payoff | P−C | −D |

| Joint Payoff | V−R−C | −R |

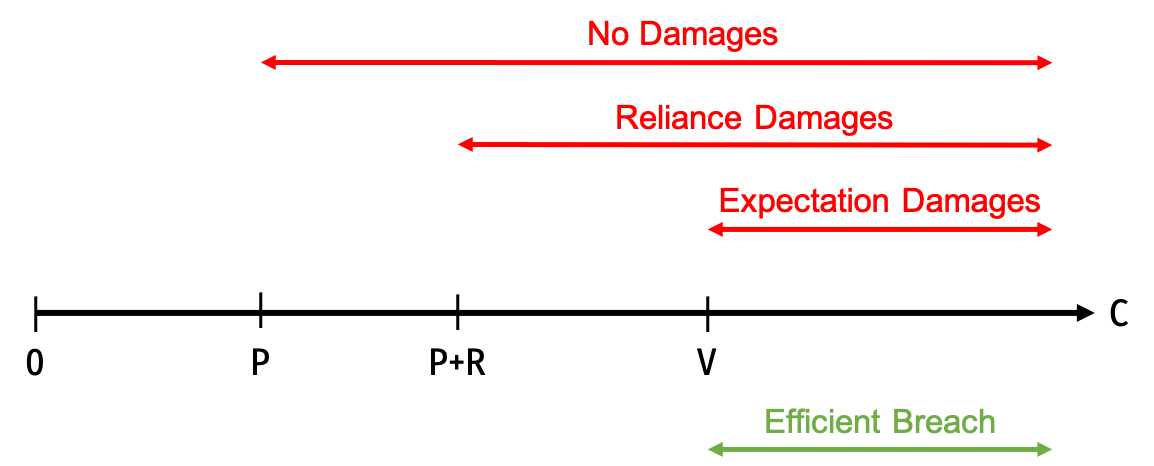

What Do Courts Set Damages At?

Finally, consider a rule of no damages (D=0)

Promisor will want to breach whenever C>P

- Will want to breach even more often than reliance (or expectation) damages

- Recall it's only efficient to breach when C>V, and V>P

What Do Courts Set Damages At?

Ranges of production costs over which breach occurs under the various damage measures

An Example

- Example: I am an aircraft manufacturer, you and I sign a contract

- You agree to pay me $350,000

- I agree to deliver an airplane to you

- You value the airplane at $500,000

- I expect it will cost me $300,000 to produce

- V: $500,000

- P: $350,000

- C: $300,000

An Example

- If contract is performed:

| Party | Payoff | |

|---|---|---|

| You | V-P = | $150,000 |

| Me | P-C = | $50,000 |

| Joint | V-C = | $200,000 |

- V: $500,000

- P: $350,000

- C: $300,000

An Example

Suppose my costs rise to $400,000

- I don't want to perform (P<C′)

- But efficient to perform (C′<V)

If contract is performed:

| Party | Payoff | |

|---|---|---|

| You | V-P = | $150,000 |

| Me | P-C' = | -$50,000 |

| Joint | V-C' = | $100,000 |

- V: $500,000

- P: $350,000

- C': $400,000

An Example

Suppose my costs rise to $400,000

- I don't want to perform (P<C′)

- But efficient to perform (C′<V)

Under expectation damages: I would owe you $150,000

- Since D<P−C′, I'll perform (better to lose only $50,000!)

- Efficient performance, since C′<V!

| Party | Payoff | |

|---|---|---|

| You | V-P = | $150,000 |

| Me | P-C' = | -$50,000 |

| Joint | V-C' = | $100,000 |

- V: $500,000

- P: $350,000

- C': $400,000

- D=V-P: $150,000

An Example

Suppose my costs rise to $600,000

- I don't want to perform (P<C″)

- Efficient to not perform (C″>V)

If contract is performed:

| Party | Payoff | |

|---|---|---|

| You | V-P = | $150,000 |

| Me | P-C'' = | -$250,000 |

| Joint | V-C'' = | -$100,000 |

- V: $500,000

- P: $350,000

- C'': $600,000

An Example

Suppose my costs rise to $600,000

- I don't want to perform (P<C″)

- Efficient to not perform (C″<V)

Under expectation damages: I would owe you $150,000

- Since D>P−C″, I will breach (better to lose only -$150,000)

- Efficient breach, since C″>V!

| Party | Payoff | |

|---|---|---|

| You | D = | $150,000 |

| Me | -D = | -$150,000 |

| Joint | D-D = | $0 |

- V: $500,000

- P: $350,000

- C'': $600,000

- D=V-P: $150,000

An Example with Reliance

- Example: I am an aircraft manufacturer, you and I sign a contract

- You agree to pay me $350,000

- I agree to deliver an airplane to you

- You value the airplane at $500,000

- I expect it will cost me $300,000 to produce

- You buy a $75,000 hangar that increases the value of performance to $600,000

- V': $600,000

- P: $350,000

- R: $75,000

- C: $300,000

- D: ?

An Example with Reliance

- Example: I am an aircraft manufacturer, you and I sign a contract

- You agree to pay me $350,000

- I agree to deliver an airplane to you

- You value the airplane at $500,000

- I expect it will cost me $300,000 to produce

- You buy a $75,000 hangar that increases the value of performance to $600,000

- With your reliance investment in the hangar, If I breach the contract, should I owe...

- $150,000? (V-P, value of original promise)

- $175,000? (V'-P, value of performance after your investment)

- $225,000? (V-P+R, value of original promise plus your reliance investment)

- V': $600,000

- P: $350,000

- R: $75,000

- C: $300,000

- D: ?

An Example with Reliance

- To get efficient breach only, damages must include the added benefit from reliance

- You anticipate benefit (with hangar) of $175,000 (V′−P−R)

- If D>175,000, I will breach too often (any time C>P, rather than only when C>V)

- V': $600,000

- P: $350,000

- R: $75,000

- C: $300,000

- D: ?

An Example with Reliance

But this affects your incentives about how much to rely on my performance; your payoffs if:

- No hangar and I perform: $150,000 (500,000-350,000)

- No hangar and I breach (with expectation damages): $150,000

- Hangar and I perform: $175,000 (600,000-350,000-75,000)

- Hangar and I breach (with expectation damages that include the full amount): $175,000

So if expectation damages include the full added benefit, promisee will over-rely!

- V': $600,000

- P: $350,000

- R: $75,000

- C: $300,000

- D: ?

Expectation Damages and Overreliance

So if expectation damages include the full added benefit, promisee will over-rely!

Creates a moral hazard problem

- Promisee inefficiently over-invests in reliance

- Expectation damages fully insure buyer against risk of breach, behaves as if performance were certain

- Promisee has no incentive to take precautions against possibility of breach

Reliance and Breach

If damages include full added benefit from reliance, promisee will invest more than the efficient amount in reliance

But if damages exclude the added benefit, then promisor will breach more often than is efficient, and underinvest in performance

- Promisor's liability < Promisee's benefit from performance

- D<(V′−P)

Reliance and Breach

- Paradox of compensation: a single “price” (damages owed) sets multiple incentives

- How much the promisor will invest in performance, whether or not to breach or perform

- How much the promisee will invest in reliance

- Impossible to set them all efficiently!

Efficient Reliance

Cooter & Ulen: include only efficient reliance

- Perfect expectation damages: restore promisee to level of well-being she would have gotten from performance if she had relied the efficient amount

- Promisee rewarded for efficient reliance, not overreliance

Actual courts: include only forseeable reliance

- How much promisor could reasonably expect promisee to rely

Forseeable Reliance: Hadley v. Baxendale

Hadley v. Baxendale (1854) EWHC J70

Hadley owned a flour mill, crankshaft broke

Hired Baxendale to transport broken shaft for repair

- Baxendale shipped by boat instead of by train, causing a delay of a week

Hadley sued Baxendale for week of lost profits

Overreliance

Hadley v. Baxendale (1854) EWHC J70

Defendant conceded negligence in delaying the delivery, but claimed the requested damages were too high, since the need for the mill to close was only a “remote” possibility

“The shipper assumed that Hadley, like most millers, kept a spare shaft...Hadley did not inform him of the special urgency in getting the shaft repaired.”

Hadley v. Baxendale

- Court elucidated the following rule:

“Where two parties have made a contract which one of them has broken, the damages which the other party ought to recieve in respect of such breach of contract should be such as may fairly and reasonably be considered either arising naturally, i.e., according to the usual course of things, from such breach of contract itself, or such as may reasonably be supposed to have been in the conemplation of both parties, at the time they made the contract, as the probable results of the breach of it.”

Hadley v. Baxendale

Hadley v. Baxendale (1854) EWHC J70

In other words, expectation damages for breach will be limited to a reasonable level

- What the parties could have reasonably foreseen at the time they made the contract

- And liable for no more than that

Found the lost profits were not reasonably forseeable, thus not entitled to damages on those

Hadley v. Baxendale

“But it is obvious that, in the great multitude of cases of millers sending off broken shafts to third persons by a carrier under ordinary circumstances, [these particular] consequences would not, in all probability, have occurred, and these special circumstances were here never communicated by the plaintiffs to the defendants. It follows, therefore, that the loss of profits here cannot reasonably be considered such a consequence of the breach of contract as could have been fairly and reasonably contemplated by both the parties when they made this contract”

Reasonably Forseeable Reliance

Default Rules

Forseeable Reliance

Why didn’t Hadley and Baxendale just specify in the original contract what happens in the event of a delay?

What rules should apply in circumstances that aren’t specified in a contract?

Complete Contracts

In economics & contract theory, a complete contract specifies all actions or transfers that parties must take under every possible contingency

In the real world of uncertainty, complete contracts are impossible

Instead people maximize their expected utility given limited information at the time (“bounded rationality”)

Consequences of Incomplete Contracts

Agreements are always incomplete contracts, actions for many (unforeseen) contingencies are unspecified

Even for specified actions and contingences, outcomes are indeterminate due to enforcement costs

- argument about interpretation

- slow litigation process, legal fees

Gives rise to post-contractual opportunism (shirking, fraud, renegotiation, hold-up, etc)

I Am Altering The Deal...

...Pray I Don't Alter it Any Futher

Asides: I/O & Theory of Firm

Research in industrial organization about how firms solve these problems of transaction costs

- vertical integration to prevent post-contractual opportunism

- contractual restraints (that look like they create market power but are actually efficient)

Note this line of research comes directly out of Coase (1937): firms are a solution to high transaction cost situations

- Coase (1960): the law is another

Firm as Owner of Residual Control Rights

Oliver Hart

1948-

Economics Nobel 2016

"We define the firm as being composed of the assets (e.g., machines, inventories) that it owns. We present a theory of costly contracts that emphasizes that contractual rights can be of two types: specific rights and residual rights. When it is too costly for one party to specify a long list of the particular rights it desires over another party's assets, it may be optimal for that party to purchase all the rights except those specifically mentioned in the contract. Ownership is the purchase of these residual rights of control." (p.692).

Hart, Oliver and Sanford J Grossman, 1986, "The Costs and Benefits of Ownership: A Theory of Vertical and Lateral Integration," Journal of Political Economy 94(4): 691-719

Default Rules

Gaps in contracts: risks or circumstances not explicitly addressed

- (In a world of no transaction costs, parties could specify all possible contingencies, nothing left unclear)

- Can be inadvertent or deliberate

Default rules: the rules courts apply to fill in gaps

How Much Should We Write Into a Contract?

- Better to include a contingency in a contract or leave it a gap?

- Allocating a risk ex ante before it becomes a loss for someone

- Versus allocating a loss ex post

- Only have to deal with this if it actually occurs

What Should the Default Rules Be?

Cooter & Ulen: use the rule parties would have wanted if they had chosen to bargain over this issue

- this will be whatever rule is efficient

Normative Coase Theorem implies law should minimize transaction costs

- filling a gap requires some cost, so use the rule the parties would have wanted had they hashed it out

- that way, most contracts can just rely on the default rule rather than hash it out

What Should the Default Rules Be?

Don’t want ambiguity in law, so default rule can’t be different case by case

Majoritarian default rule: the terms that most parties would agree to

- In cases where rule is not efficient, parties can still agree to override it in their contract

Court: figure out efficient allocation of risks (what parties would have done)

Default Rules: Example

Suppose a family contracts with construction company to build house

Construction company knows: 50% chance of costs increasing by $2,000

- In expected value, costs will be $1,000 higher due to this risk

The company can hedge this risk (buy supplies in advance and keep in storage, etc.) at a cost of $400

Family doesn’t know anything about this possibility, and has no way to mitigate the risk

Default Rules: Example

The company chooses not to hedge against the risk

It turns out, costs indeed went up $2,000

- Company raises the price on the family ($2,000), family refuses to pay, case goes to court

How should the court address this?

- Original contract says nothing about the risk of higher construction costs

Default Rules: Example

Construction company here is the efficient bearer of the risk

- Cost to family was $1,000 in expected value, no way to mitigate

- Company could have mitigated it for $400

An efficient contract would have allocated the risk to the company

Default Rules: Example

Should court adjust prices to compensate?

Court might rule the spike in costs was reasonably forseeable

- If forseeable, safe to assume already incorporated in price (compensating company for bearing risk)

It might not have been reasonably forseeable

- Company might still be efficient bearer of risk, but not part of price (unforseen risk)

- Court might rule for the family, but have them pay a different price to compensate Company for the risk

Default Rules: Penalty Default

Sometimes better to make default rules something the parties would not have wanted, a penalty default

- Gives an incentive for parties to address the issue rather than leave a gap

- Incentive to disclose information

Ayres & Gertner argue sometimes gaps are result not of transaction costs, but strategic reasons

- holdout problems, asymmetric information

Ayres, Ian and Robert Gertner, 1989, “Filling Gaps in Incomplete Contracts: An Economic Theory of Default Rules,” Yale Law Journal 99

Hadley v. Baxendale Rule: Penalty Default?

Baxendale (shipper) is only one who can affect when crankshaft is delivered — efficient bearer of risk

- It was his decision to ship via a slower method which hurt Hadley’s profits

- If Baxendale were liable, he would have internalized this external cost

If default rule held Baxendale liable, Hadley has no need to tell him the shipment is urgent!

- Which he didn’t, and so Baxendale inadvertently chose a less efficient shipping method

So Hadley might conceal this information, which is inefficient

Hadley v. Baxendale Rule: Penalty Default?

Ayres and Gernet: Hadley vs. Baxendale ruling was correct, not because it was efficient, but because it was inefficient!

Ruling created incentive for disclosing information and forcing parties to prevent inefficient gaps in contracts

Hadley v. Baxendale Rule: Penalty Default?

To see their logic, suppose

- 80% of millers are low damage — suffer $100 loss in delay

- 20% of millers are high damages — suffer $200 loss in delay

If shipper is liable for actual damages

- Average miller would suffer $120 in losses

- Shipper makes efficient investment for average miller

- But not efficient for either type

If shipper is liable for forseeable damages (Hadley rule)

- Shipper makes efficient investment for low-damage millers

- High-damage millers have strong incentive to negotiate around default rule

When To Use Penalty Defaults

Look at why parties left a gap in a contract:

If due to high transaction costs → use efficient rule

If due to strategic reasons → penalty default may be more efficient